Athena

Behavioral

Tactical Fund

Overview

The Athena Behavioral Tactical Fund employs a tactical market rotation strategy that seeks to invest in the right market at the right time.

I Shares

-

ATVIX

Ticker -

1.53%

Net Expense Ratio -

2.59%

Gross Expense Ratio -

N/A

Maximum Sales Charge -

$100,000

Minimum Investment -

66538B388

CUSIP

Objective and Strategy

The Athena Behavioral Tactical Fund (the “Fund”) seeks capital appreciation.

The Fund utilizes patented behavioral market indicators to gauge and select broad market exposure among various equity markets, market capitalization, or cash each month. The Fund invests in positions within US small cap, US large cap, or international equities when market indicators are strong. When indicators are very strong, the Fund’s exposure can increase to twice the market to enhance returns. When indicators are weak, the Fund can move to 100% cash.

Tactical Tilt

Systematically deliver a tactical tilt to your overall portfolio to potentially make it more responsive to market conditions.

Market Rotation

Variable Exposure

Performance

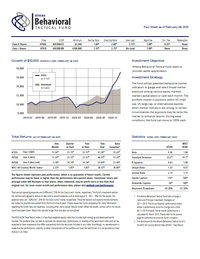

Growth of $10,000 (MARCH 11, 2019 – SEPTEMBER 30, 2024)

Statistics (APR 2019 – SEP 2024)

| ATVIX | ACWI | |

|---|---|---|

| Beta | 0.76 | 1.00 |

| Standard Deviation | 18.6% | 16.8% |

| R-Squared | 0.47 | 1.00 |

| Sharpe Ratio | 0.53 | 0.71 |

| Sortino Ratio | 0.95 | 1.14 |

| Upside Capture | 74% | 100% |

| Downside Capture | 65% | 100% |

| Maximum Drawdown | -31.13% | -25.61% |

ATVIX Ratings & Rankings (As of 9/30/2024)

Morningstar Rating™

| Overall | |

| 3 Year | |

| 5 Year |

Tactical Allocation Ranks

| 1 Year | #61 out of 241 |

| 3 Year | #202 out of 229 |

| 5 Year | #23 out of 210 |

Athena Behavioral Tactical Fund I was rated based on risk-adjusted returns against the following numbers of Tactical Allocation funds over the following time periods: 229 funds overall and in the last three years and 210 funds in the last five years. Past performance is no guarantee of future results. Morningstar Rating™ is for the I share class only; other classes may have different performance characteristics.

The Morningstar Rating™ for funds, or “star rating”, is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The Morningstar Rating does not include any adjustment for sales loads. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10- year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

Rank in Category is the fund’s total-return absolute rank relative to all funds that have the same Tactical Allocation category. The highest (or most favorable) absolute rank is 1 and the lowest (or least favorable) absolute rank is equal to the number of funds in the category. The top-performing fund in a category will always receive a rank of 1.

© 2024 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

-

Total Returns

As of September 30, 2024One

MonthYear

to DateOne Year Three

YearFive

YearSince

Inception1ATVIX Class I (NAV) 0.74% 7.91% 22.28% -0.49% 9.60% 9.88% MSCI All Country World Index2 2.32% 18.66% 31.76% 8.09% 12.19% 11.96% -

Historical Performance

As of September 30, 2024One

YearThree

YearFive

YearSince

Inception3ATVIX Class I (NAV) 22.28% -0.49% 9.60% 6.34% MSCI All Country World Index 31.76% 8.09% 12.19% 9.21%

The figures shown represent past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

Total annual operating expense is 2.59% for Class I shares. The Fund’s investment advisor has contractually agreed to reduce its fees and/or absorb expenses until at least August 31, 2025. After this fee waiver, the expense ratio is 1.25% for Class I shares. These fee waivers and expense reimbursements are subject to possible recoupment from the Fund in future years. Please review the Fund’s prospectus for more information regarding the Fund’s fees and expenses, including other share classes. Results shown reflect the waiver, without which the results could have been lower. Returns for periods longer than one year are annualized.

The MSCI ACWI Total Return Index is a free-float weighted equity index that includes both emerging and developed world markets. The portfolio does not seek to replicate the composition, performance, or volatility of the benchmark index and can be expected to have investments that differ substantially from the securities included in any index. Accordingly, no representation is made that the performance, volatility, or other characteristics of the portfolio will track the benchmark. It is not possible to invest directly in an index.

Notes

- The Athena Behavioral Tactical Fund had a change in name and Principal Investment Strategies on 03/11/2019. The Since Inception performance shown on the Month End tab is performance since this change and is from 03/11/2019 onward. Partial month performance is calculated for March 2019.

- The benchmark for the Athena Behavioral Tactical Fund is the MSCI All Country World Index (ACWI) – Total Return.

- The Athena Behavioral Tactical Fund had a change in name and Principal Investment Strategies on 03/11/2019. The Since Inception performance shown on the Quarter End tab is performance since the Fund’s inception on 05/15/2015. Returns for periods longer than one year are annualized.

Literature

Reports

Annual Reports

Portfolio Reports

Proxy Voting Reports

Purchase

How to Invest

The fund is available for purchase on most major retail brokerage platforms or you can open an account directly with the fund. Please use the forms available here.

Taxable Accounts

Qualified Accounts

Investors should carefully consider the investment objectives, risks, charges, and expenses of the Athena Behavioral Tactical Fund. This and other important information about the Fund is contained in the Prospectus, which can be obtained by contacting your financial advisor or by calling (888) 868-9501. The Prospectus should be read carefully before investing. The Athena Behavioral Tactical Fund is distributed by Northern Lights Distributors, LLC member FINRA/SIPC. AthenaInvest Advisors LLC and Northern Lights Distributors, LLC are not affiliated. Mutual Funds involve risk including the possible loss of principal.

20241009-3924390